It’s hard to hear it above the din, but the renter eviction moratorium has housing trade groups and nonprofits sounding an alarm.

“Rental assistance is necessary to pull the country back from the brink of a housing and financial crisis,” according to groups calling on Congress to step in that include the National Association of Realtors, National Association of Home Builders, Mortgage Bankers Association, National Affordable Housing Management Association, National Multifamily Housing Council, National Association of Housing Cooperatives, National Apartment Association and others.

The devil is in the details of this road paved with good intentions.

“This is fluid right now and seems to be changing frequently. It sounds great to keep people in their homes, but making the total rents due Jan. 1, and allowing fees and interest (if it is in the lease) is setting people up to fail. That combined with the people (landlords) not able to pay the mortgage without the rent and being foreclosed on is going to end up putting people on the street in spite of these good intentions,” — Kathy Fowler, secretary-treasurer of the Oklahoma City Metro Association of Realtors and managing broker at McGraw Realtors.

Now more than ever, “We are all in this together.” The seemingly adversarial interactions of the past no longer serve anyone. Those representing rental housing and those representing folks living in rental housing must work in unison to fix problems that have existed in the lower end of the market for as long as I’ve been in business.

A spokeswoman for the Legal Aid Society of Cleveland, which frequently represents tenants facing eviction, also noted that landlords’ financial well-being is crucial for people to maintain housing.

“Rent assistance is needed to ensure rent payments continue to be paid to landlords. Without rent assistance to help fund this order, many tenants will face an insurmountable rent burden when the moratorium lifts,” the spokeswoman said. “Also, there will be a profound impact on many landlords’ ability to continue their business.”

In 1991, I was interviewed by a few national publications regarding the termination of a Christmas eviction moratorium in Milwaukee. While those articles are not online, a similar statement I made in a 2010 NYT article is:

Tim Ballering, who owns or manages some 900 rental units in Milwaukee, said a basic problem was the growing imbalance between low-end incomes and rents. A minimum-wage worker may gross little more than $1,100 a month; a welfare recipient in Wisconsin receives $673 a month, while two-bedroom units start at about $475.

“On $673 a month, how do you buy tennis shoes for the kids, clean shirts for school and still pay your rent?” Mr. Ballering said.

Nearly 30 years later, not much has changed. Maybe COVID will be a blessing in disguise, allowing meaningful discussions that extend well past this current crisis.

This is one of the better articles I’ve read outlining the problems and questions surrounding the CDC order

https://www.govinfo.gov/content/pkg/FR-2020-09-04/pdf/2020-19654.pdf

The earlier CDC release stated that tenants did not have to provide proof with the declaration, but the landlord could request/challenge it.

The published rule, but of course it is not a rule, but an order, as rules have rules, does not appear to have a mechanism to challenge the validity of the tenants’ declarations. (see below) Instead, I guess you have to report the tenant to the FBI if you feel they lied.

It is uncertain what an owner must do to be found in violation. Do you actually have to evict after receiving a declaration, which courts should prevent from occurring? Or would issuing a summons after receiving a declaration trigger a violation? But how do you challenge the validity of the declaration if not in court?

I do not see specifically that issuing a 5-Day notice is a violation, but I’m sure that will be argued.

https://www.nytimes.com/2020/09/02/your-money/eviction-moratorium-covid.html

A lawyer can also help if a landlord tries a different approach. For instance, a landlord might try to sue in small claims court over partial payments, without filing an eviction notice that might be illegal under the order, Mr. Dunn said.

The sample declaration form does not say anything about whether I need to prove my hardship to my landlord. Should I attach bank statements or other documents?No, not to the declaration — at least not at first. The way the order is written means you need not lay out specifics in your declaration, said Emily Benfer, a visiting professor of law at Wake Forest University.

If the landlord challenges your initial assessment, however, you should provide “reasonable” specifics to prove your eligibility, according to senior administration officials who helped write the order.

This last sentence was in the CDC press release two days ago but is absent now.

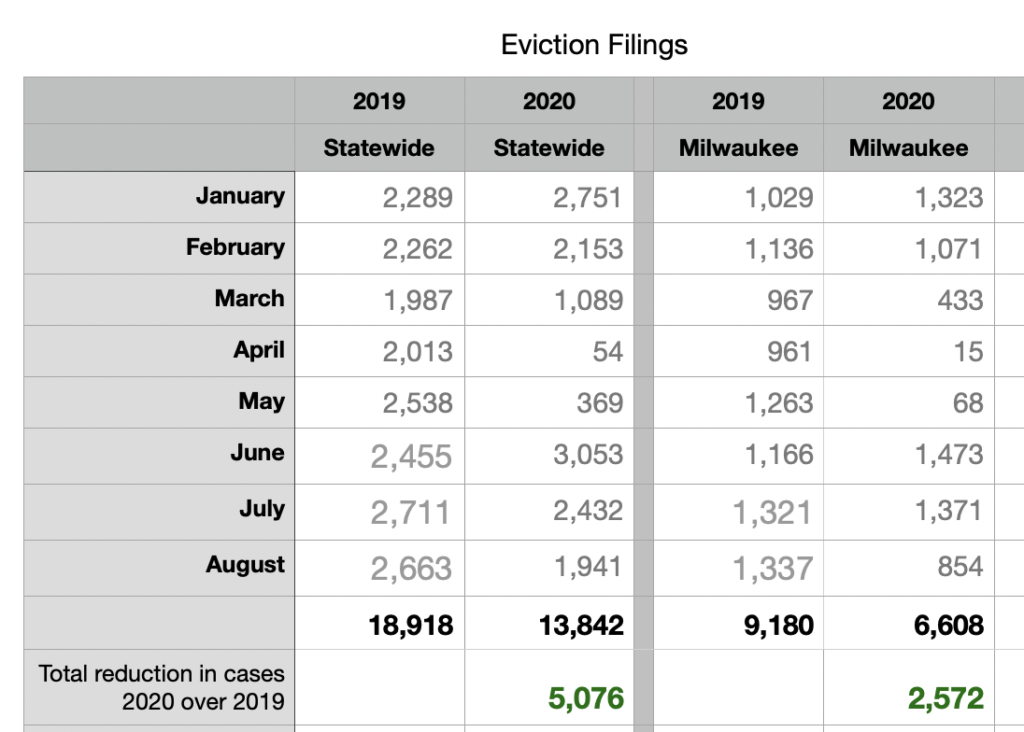

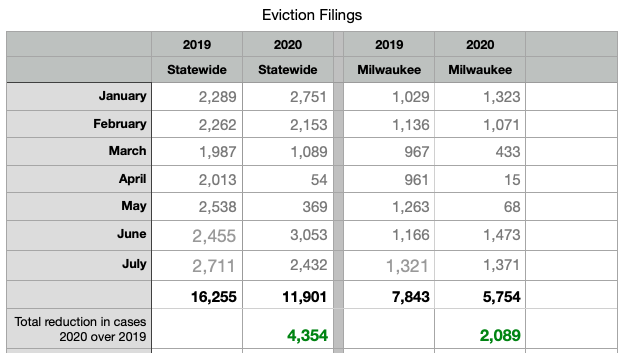

Matt Desmond’s op-ed piece in today’s NYT is a prime example of the over-emphasizing of relative differences in eviction filings:

“In the last week of July, eviction filings were 109 percent above average levels in Milwaukee.”

— https://www.nytimes.com/2020/08/29/opinion/sunday/coronavirus-evictions-superspreader.html

If one narrows the range enough, picking and choosing that which fits their predefined scenario, one can use otherwise factual data to say anything.

A more accurate reflection of what is happening in the Milwaukee rental market is eviction filings are down by 26.6% YTD through 07/31/2020, despite an anecdotal 8-12% greater than normal non-payment. Rent has always been the financial elasticity in the “C” market, be it Christmas gifts, car repairs, or job loss.

If too many owners fail because they cannot collect enough rent to cover expenses, housing opportunities will only become more restricted and expensive. Municipalities will also fail as they “eat” three to four times more rent dollars in property taxes and municipal utilities than typical owners receive for their efforts and return on investment.

Many scholars are warning of such widespread failures in the rental market. One example: Tenant Rights, Eviction, and Rent Affordability (July 4, 2020). Available at SSRN: https://ssrn.com/abstract=3641859 or http://dx.doi.org/10.2139/ssrn.3641859

In national interviews dating back to 1991, I’ve pointed out the near impossibility of paying rent for those with limited income. While the older articles are not online, here is a NYT interview from a decade ago:

“On $673 a month, how do you buy tennis shoes for the kids, clean shirts for school and still pay your rent?” Mr. Ballering said.” ($673 was the W2, welfare, cash benefit at the time)

— https://www.nytimes.com/2010/02/19/us/19evict.html

Sadly nothing has changed in these 30 years.

I fully agree with Desmond’s statement buried near the end of the op-ed, “Eviction is not a solution to landlords’ fundamental problem of maintaining rental income. Rent relief is.” I would have been pleased to see this as your closing call to action.

The COVID crisis presents an opportunity for housing advocates, whether from the tenant or property owner perspective, to jointly push for a long term solution, which Matt Desmondinitially advocated for; portable housing vouchers.

A published research paper that found:

“Our research shows that in order to keep rental housing affordable and sustainable for low-income families, lawmakers have to walk a fine line in determining what will benefit the tenant and what may ultimately be detrimental to them,” Shen said. “On the surface, strict landlord regulation sounds good for tenants, but our paper points out, the solution isn’t that simple. The research suggests that conventional thinking on the issue of more regulation may have the opposite effect on tenants.”

“Though advocating for tenant rights seems noble and the right thing to do, the resulting consequences could have a devastating impact on this vulnerable population,” Shen said. “Our research indicates that if landlords aren’t allowed to evict, rent will likely increase to compensate for their losses. The housing supply would diminish, though the demand would still exist. These landlords may choose alternative investments if owning property is no longer feasible. A reduced housing supply would mean less competition, which would drive up the cost of rent for everyone.

Coulson, N. Edward and Le, Thao and Shen, Lily, Tenant Rights, Eviction, and Rent Affordability (July 4, 2020). Available at SSRN: https://ssrn.com/abstract=3641859 or http://dx.doi.org/10.2139/ssrn.3641859

I grabbed a few of the more pertinent paragraphs, but he article is a worthy read in its entirety.

https://www.nytimes.com/2020/08/21/business/economy/rent-tenants-evictions.html

- Instead of an avalanche, the appropriate metaphor might be a receding tide that is exposing layers of financial insecurity.

- Even before the pandemic, about 25 percent of tenants were paying at least half their pretax income for housing.

- Even as corporate landlords report little change, smaller landlords are reporting declining collections and in many cases expect to use loans and personal savings to cover shortfalls.

- Partly this is because these landlords have less access to capital than large corporations, but buildings like duplexes and triplexes — the kinds of properties that many small landlords own — tend to be more affordable, so they attract lower-income tenants, who have been hit the hardest by the pandemic.

- Several tenants haven’t paid rent. Others are making partial payments and asking for extended payment plans. “At the beginning of the pandemic, I expected what I’m seeing now,” [the landlord] said.

- Avail, a platform that helps small landlords manage their properties, recently surveyed about 5,000 tenants and landlords and found that 42 percent of tenants and 35 percent of landlords were pulling money from savings and emergency funds to make it through the pandemic.

July saw Milwaukee evictions up less than 4% over last year, despite local owners reporting 8-18% less rent collected than normal.

Statewide, July evictions are down 10%

The big story is January through July saw statewide and Milwaukee evictions both down just under 27% over last year, again despite the industry suffering well above normal rent losses.

A chilly forewarning from Bloomberg:

While landlords at the priciest, amenity-rich apartments have collected most of their rent payments during the pandemic, owners of older, less fancy units — the backbone of the nation’s affordable housing supply — haven’t fared as well.

The CEO of the National Apartment Association tells Bloomberg in the same article

Further erosion in those rent payments would endanger America’s affordable housing supply and put mom-and-pop landlords at the biggest risk of mortgage default. Should their buildings go into foreclosure, the buyers may not keep them affordable, or even as rentals, said Robert Pinnegar, chief executive officer of the National Apartment Association, a landlord advocacy group. High construction costs make adding any new supply unlikely.

“If we lose this product through the crisis, we’re never going to be able to build it again,” Pinnegar said. “We risk making the affordability crisis much worse on the other side.”

This all makes sense.

Lease Lock and others are reporting a 16% decline in July collections over pre-COVID rates in the below-median rent segment of the market. The National Apartment Association and the US Census put the net operating income of rental properties at 7-9% gross rent, with the NAA showing the higher rate of return.

If collections are down 16% and owners were only receiving 7-9% pre-COVID, it is easy to see how properties will be financially upside down in short order.

If you go back to the US Census research you will find that 73% of the nation’s rental housing is owned by individuals. That number is probably much higher as many small owners hold title as LLCs.

For a more in-depth view of the economics and potential for a massive housing crisis on the other side of this read, Tenant Rights, Eviction, and Rent Affordability, a published research paper