If you want to share this or any other housing concerns with your elected officials, go to democracy.io and enter your address. The site allows you to write to both your US Senators and your Congressperson at the same time without searching for their emails or finding who represents you.

We should be asking for housing assistance to prevent the failure of both renters and housing.

If you do write – I’d appreciate if you send me a copy to Tim@ApartmentsMilwaukee.com

Notes on housing, supported by reliable sources such as Census.gov

74.4 % of rental properties owned by individual investors. Source: https://www.census.gov/newsroom/press-releases/2017/rental-housing.html and in an easier to read format in this report from Harvard: https://www.jchs.harvard.edu/blog/who-owns-rental-properties-and-is-it-changing

55% of rental units as owned by part-time landlords: https://www.avail.co/education/articles/state-independent-landlords-2017

Rent debt will be $25-34B by January 1st. https://www.ncsha.org/resource/current-and-expected-rental-shortfall-and-potential-eviction-filings/

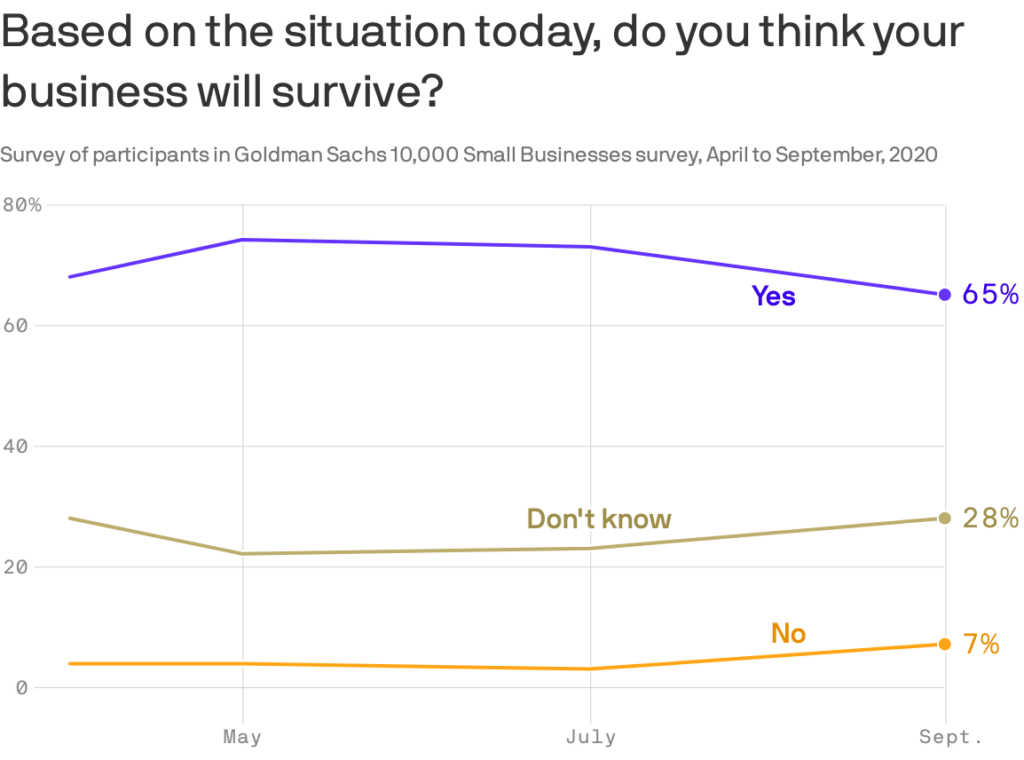

roughly 10 – 14 million renter households — home to 23 – 34 million renters — were behind on their rent by a total of roughly $12 – $17 billion as of September 14, 2020.

These renters will owe $25 – $34 billion by January 2021,

(from a chart just below the P1 fold)

More State-Specific info at: https://assets.aspeninstitute.org/content/uploads/2020/08/chart3_fsp.png

Local economic multiplier of rent payments from a report by Brookings Inst.

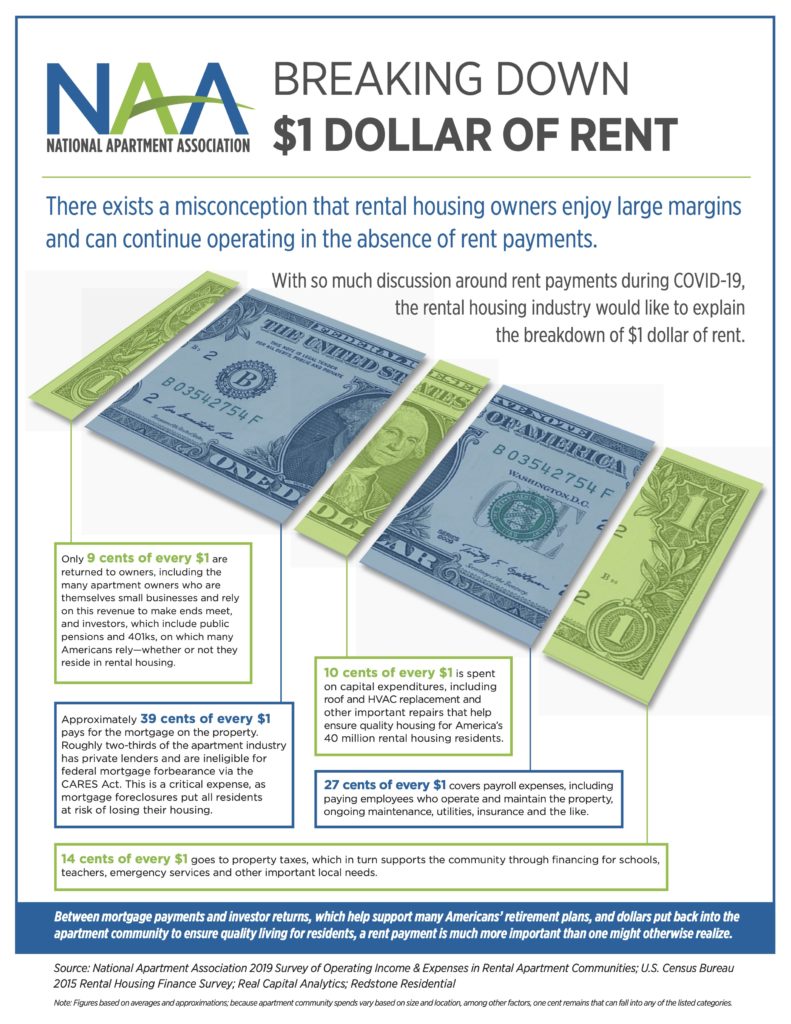

RENT HAS IMPORTANT MULTIPLIER EFFECTS IN THE LOCAL ECONOMYRent checks don’t just line the pockets of fat cat landlords—they also contribute to essential government services and other workers’ wages. If many households are simultaneously unable to pay rent, the economic impacts will be felt throughout the local economy.

The first entity that gets paid by a monthly rent check isn’t the landlord—it’s the local government. Property taxes have a higher priority even than mortgages; if a landlord falls behind on both property taxes and mortgage payments, the local government’s claim supersedes the lender’s.

Cities and counties rely on property taxes from all their constituents—individual homeowners as well as owners of apartments, offices, and other nonresidential properties—to cover the cost of providing public services. Although local governments could defer property tax payments during the current crisis, the pandemic is already stressing local government budgets. Cities are front-line providers of health care and emergency services, and also need money right now to feed children whose public schools are shut down and care for older adults and vulnerable populations.

https://www.brookings.edu/blog/the-avenue/2020/03/25/halting-evictions-during-the-coronavirus-crisis-isnt-as-good-as-it-sounds/

Census reports that the average rental unit generates $1,198 per unit per year in wages.

https://www.census.gov/data-tools/demo/rhfs/#/?s_byGroup1=12&s_tableName=TABLE4&s_type=2

Mean Payroll Costs for Employees Per Housing Unit 1,198

We can fix evictions for what it costs to allow the problem to continue

https://assets.aspeninstitute.org/content/uploads/2020/08/Evictions-Data-Update-August.pdf

Providing shelter and services to a family experiencing homelessness can cost local governments $10,000,[1] which is more than the $9,120 average annual cost of one housing voucher to the federal government[2]

[1] Evans, William, James Sullivan, and Melanie Wallskog. “The Impact of Homelessness Prevention on Homelessness.” Science, 333:6300 694–6999, 2016. https://science.sciencemag.org/ content/353/6300/694.full.

[2] U.S. Department of Housing and Urban Development. “Snapshot of Housing Choice Vouchers, 2016,” June 2018, https://www.huduser.gov/portal/elist/2018-june_08.html.

Impact of the 2008 housing crises on Milwaukee

The following is from a letter we wrote to Milwaukee’s mayor. It outlines some of the economic factors of rental housing and the harm that will come if there is a mass failure. In 2008 smart money could see prices rising over a two and a half year period at a rate not sustainable by wages. In 2020 the economy was screaming, then two weeks later it stopped. The suddenness of the event is a recipe for disaster.

If action is not taken to avert this, the aftermath of 2008 will look like a walk in the park on a sunny day.

A December 2019 Milwaukee Dept of City Development report stated “The economic impact of the Great Recession and mortgage foreclosure crisis has had a significant, detrimental, and ongoing effect on City households.” DCD 12/2019.[ii] Foreclosure filings in Milwaukee County were three times higher in 2009 than last year.[iii] From 2008 through 2010,16,000 Milwaukee properties were in some stage of foreclosure by lenders and the city.[iv] In those two years, the tax base lost almost $2 billion in value, with a resulting $16.7 million loss of tax revenue. The resulting demolitions had a large impact on the City’s budget due to the cost of razing along with the impact on the property tax and municipal services collections.[v] The neighborhoods where those properties were located suffered long-term damage. We continue to feel that impact even today, and we certainly hope to avoid a similar outcome in the future.

[ii]Section 2: Housing Needs and Demand Housing Affordability Report Department of City Development | December 2019 https://storymaps.arcgis.com/stories/eb043b089173407aa469eba948dd9601

[iii] State’s Foreclosure Rates Have Plummeted » Urban Milwaukeehttps://urbanmilwaukee.com/2019/07/11/states-foreclosure-rates-have-plummeted/

[iv] www.sewrpc.org/SEWRPCFiles/HousingPlan/Files/foreclosure-in-milw-progress-and-challenges.pdf

[v] Tom Barrett wants to spend $2.4 million on home demolition, rehabarchive.jsonline.com/news/milwaukee/barrett-wants-to-spend-24-million-on-home-demolition-rehab-b9933176z1-211401301.html/